[ad_1]

A credit score rating is a three-digit quantity that may drastically influence your life.

A credit score rating is a three-digit quantity that may drastically influence your life.

The seemingly small quantity displays a measure of your creditworthiness, which might have an outsized impact in your funds. credit score rating can unlock a decrease rate of interest on long-term loans, which might prevent 1000’s. However a weak credit rating might bar you from accessing inexpensive loans for main purchases equivalent to a house or automotive.

Clearly, your credit score rating is vital. We’ll discuss simply how important beneath. However how will you construct credit score? We’ll additionally cowl the perfect methods to offer your credit score rating the enhance it wants.

What Is Credit score-Constructing?

Credit score-building employs methods to enhance your credit score rating. Wherever your credit score rating at the moment stands, credit-building may also help you are taking it to the subsequent stage.

The objective of credit-building is to create a historical past of accountable credit score utilization. Meaning opening credit score accounts and making on-time funds to maintain these accounts in good standing.

To start out, constructing credit score will be so simple as that—making on-time funds to your accounts. The one draw back is that it may well take time to create a strong fee historical past on your credit score report. In truth, it takes round two years for a credit score account to be ‘seasoned.’ Seasoned accounts have sufficient age to point out potential lenders that you would be able to responsibly handle your credit score. With a number of seasoned accounts in your report, your credit score rating ought to improve.

Though it takes time to construct good credit score, the regular method of creating on-time funds to your accounts will repay.

Credit score-Constructing vs. Credit score Restore

Credit score-building and credit score restore each have the identical objective of accelerating your credit score rating. However every path has a unique technique for fulfillment.

Right here’s a better have a look at every choice.

Credit score Restore

Credit score restore needs to be step one if in case you have a weak credit rating.

Typically, credit score restore entails addressing any present destructive exercise in your credit score report. Destructive exercise might stem from errors in your credit score report or a case of id theft. The method begins by pulling a free copy of your credit score report and searching for any unhealthy marks.

For instance, you may see inaccurate details about a invoice despatched to collections in your credit score report. In that case, you’ll be able to dispute the document to have it up to date or eliminated out of your credit score report.

A weak credit rating might make a credit score restore company a tempting choice. Sometimes, the operation works by going via your credit score report so that you can root out any errors.

Though you’ll be able to pay for this service, it’s attainable to deal with credit score restore by yourself. It’ll take a while and power. However you’ll be able to observe down your credit score report and take steps to right any errors you discover.

You may be taught extra about your credit score restore choices in Tradeline Provide Firm, LLC’s article and infographic, Credit score Restore vs. Tradelines.

Credit score-Constructing

Whereas the main focus of credit score restore is to take away destructive info, however, credit-building is targeted on including optimistic info to your credit score report. Whether or not you don’t have a credit score historical past of any form or if in case you have a weak credit rating, credit-building is the proper transfer.

Primarily, constructing credit score is completed by acquiring a line of credit score to pay again on time. As you create a historical past of accountable credit score administration with constant on-time funds, you’ll construct your credit score historical past.

No Credit score vs. Dangerous Credit score: Which is Worse?

In relation to credit score scores, there are good scores and unhealthy scores.

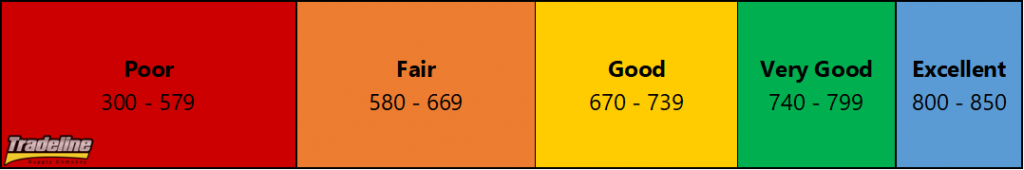

Right here’s the breakdown of credit score scores on a scale of poor to wonderful:

Mostly used credit score scores vary from 300 to 850.

When you have a credit score rating, you’ll have the ability to discover out the place you fall on the size. However what for those who don’t have any credit score in any respect? Is it higher to have a weak credit rating? Or are you higher off with no credit score rating in any respect?

Basically, it’s simpler to attain an excellent credit score rating if you’re ranging from scratch. That’s as a result of you’ll not have destructive marks in your nonexistent credit score report to deal with. With that, you’ll be able to leap straight into constructing credit score.

When you have a weak credit rating, although, you’ll want to begin credit score restore earlier than credit-building. When you have a weak credit rating as a result of a number of errors in your report, then engaged on credit score restore ought to give your credit score rating an enormous enhance. In that case, the method of credit score restore is likely to be quicker than credit-building. However if in case you have professional monetary errors in your credit score report which have led to a poor credit score rating, then it would seemingly take extra time to enhance your credit score rating.

It’ll take some work to enhance your unhealthy or nonexistent credit score rating in both state of affairs. The main points of your credit score report will decide whether or not it’s preferable to have a weak credit rating or no credit score in any respect.

A Quick Tour By way of the Phases of Constructing Credit score

The excellent news is that you would be able to construct credit score from wherever you’re beginning. Right here’s a quick tour of the phases of credit-building.

Verify Your Credit score Report

When you have a credit score historical past of any form, step one needs to be to examine your credit score report.

When you may have your free copy, examine it over for errors and errors. A couple of issues to observe for embody incorrect balances and incorrect fee dates. It’s possible you’ll or could not discover any errors. However for those who do, dispute the error with the credit score bureaus or the corporate sending the data to the credit score bureaus.

If the error is eliminated, your credit score rating might see a lift. In case you don’t discover any errors, this step will nonetheless provide help to perceive the place you’re ranging from by way of your credit score historical past.

Bringing in a constant revenue is a crucial consideration when you’re making use of for credit score.

In case you don’t have a credit score historical past but, you shouldn’t have a credit score report, however it’s a good suggestion to examine anyway. In case you uncover that you simply do have a credit score report regardless of by no means having credit score, this is a sign that somebody has fraudulently opened credit score accounts in your title, and you will want to deal with the theft of your id and the fraudulent accounts.

Keep a Regular Revenue

An revenue just isn’t part of your credit score rating. However your revenue will play an enormous position in your capability to borrow cash and repay your money owed in full and on time. With out the choice to borrow cash, it may be nearly unattainable to construct credit score.

Borrow Funds

With a gentle revenue, you could possibly take out a line of credit score of some form. Taking out a mortgage, line of credit score, or bank card is a vital a part of constructing credit score. In any other case, lenders received’t have the ability to discern the way you handle your funds.

Two well-liked credit-building decisions for these with no prior credit score historical past embody a secured bank card or a credit-builder mortgage.

Use Credit score Responsibly

Irrespective of the way you select to borrow the funds, crucial factor is to handle your credit score obligations responsibly. With a purpose to construct your credit score, you want to have the ability to reveal to lenders that you’ve got a constant sample of responsibly utilizing credit score.

As you construct a historical past of accountable credit score utilization, you’ll inch nearer to your objective of getting an excellent credit score rating.

Why Credit score Scores Matter: Good Credit score And Dangerous Credit score Cash Variations

It’ll take effort and time to construct an excellent credit score rating. Is it definitely worth the effort?

For most individuals, the reply is a powerful sure! credit score rating can have a huge impact in your general monetary image. When you have a weak credit rating or lack a credit score rating, you can be lacking out on huge financial savings alternatives, or you can be lacking out on alternatives to borrow cash within the first place.

Most customers have to take out a mortgage to have the ability to purchase a home, which is far simpler to do if in case you have an excellent credit score rating.

Large Purchases

With a greater credit score rating, you’re poised to benefit from loans for big-ticket objects with affordable rates of interest.

Let’s say that you simply need to take out a mortgage to attain your dream of homeownership, as the vast majority of dwelling patrons wouldn’t have the money to pay for such a big expense outright. Your credit score rating will influence whether or not or not you’re accredited for the mortgage and resolve what rate of interest is hooked up for those who do get accredited.

On this situation, an excellent credit score rating might make the distinction between turning into a house owner or not. As well as, an excellent credit score rating might prevent 1000’s of {dollars} in curiosity over the lifetime of the mortgage.

Insurance coverage Financial savings

These with greater credit score scores profit from decrease insurance coverage premiums.

credit score rating might influence your insurance coverage premiums in some states. It’s because insurance coverage credit score scores have been proven to correlate with a shopper’s probability of submitting an insurance coverage declare.

In truth, a latest WalletHub survey discovered that individuals with no credit score pay 67% extra for automotive insurance coverage than individuals with wonderful credit score.

Think about how shortly these prices add up when it’s a must to pay a better premium each month!

Credit score Card Perks

When used responsibly, a bank card will be an especially invaluable monetary device. However if in case you have a weak credit rating, you can be caught with a bank card for weak credit that gives no perks and a sky-high APR.

In distinction, an excellent credit score rating can open the door to many bank card choices that include useful perks. For instance, you may discover a cashback alternative or built-in financial savings while you use the cardboard, in addition to different advantages.

Video: How Your Credit score Rating Impacts the Phrases of Your Mortgage or Card

What Lenders Need to See in Your Credit score Historical past

As you construct your credit score historical past, you may surprise what lenders are searching for in a creditworthy buyer. Though there is no such thing as a laborious and quick rule, since every lender has their very own underwriting course of, the breakdown of a credit score rating offers us perception into crucial traits that lenders typically need to see when evaluating your credit score profile.

Bank card perks equivalent to money again are sometimes reserved for customers who’ve excessive credit score scores.

Cost Historical past

Cost historical past accounts for 35% of your credit score rating. In different phrases, on-time funds signify a vital element of your credit score rating. Lenders need to really feel assured that you simply make it a precedence to repay your money owed in order that they won’t incur a monetary loss by extending credit score to you.

Even one missed fee could make a critical dent in your credit score rating, so don’t take this class calmly. Making your funds on time 100% of the time is crucial factor you are able to do to earn an excellent credit score rating.

Credit score Utilization

Your credit score utilization charge represents 30% of your credit score rating. Your credit score utilization charge, additionally known as your utilization ratio, revolving utilization, or your debt-to-credit ratio, measures how a lot debt you owe in your revolving accounts in comparison with the quantity of revolving credit score you may have out there.

A decrease general utilization charge will lead to a greater credit score rating, which means that lenders can be seeking to see the way you handle your balances relative to your credit score limits. Utilizing an excessive amount of of your out there credit score reveals that you’re a higher credit score threat and lenders can be much less more likely to be prepared to work with you.

Moreover, having too many accounts with balances can even harm your credit score rating.

Size of Credit score Historical past

Lenders need to know that you’re somebody they’ll depend on to repay their funds persistently over time. To that finish, they’ll be seeking to see how lengthy you’ve been in a position to handle your credit score accounts responsibly.

Your precise age just isn’t thought-about on this, however older customers do are inclined to have longer credit score histories just because they’ve had extra time of their grownup life to build up credit score accounts and make on-time funds. With a purpose to enhance this issue, all customers can do is open accounts early on and wait for his or her accounts to age whereas diligently making funds and managing their balances.

This issue accounts for 15% of your credit score rating, however in actuality, it’s way more vital than it appears on the floor as a result of extra credit score age additionally means extra on-time funds in your fee historical past, which provides one other 35% of your rating.

Credit score Combine

Your mixture of credit score is set by the forms of accounts you may have open. Basically, lenders need to see examples of each revolving strains of credit score (e.g. bank cards) and installment loans (scholar loans, auto loans, private loans, mortgages, and so forth.) in your credit score report.

This issue accounts for 10% of your credit score rating.

Be taught extra about account varieties and account variety in our credit score combine infographic.

New Credit score

Final however not least, credit score inquiries account for the ultimate 10% of your credit score profile. Exhausting inquiries seem in your credit score report when lenders examine your credit score while you want to open a brand new credit score account with them.

Collectors don’t need to see very many of those laborious credit score inquiries acquired throughout the previous 12 months. Having too many credit score inquiries may very well be a pink flag as a result of it reveals that you’re searching for a whole lot of new credit score and is probably not in the perfect monetary place to pay your payments.

Take into account that delicate inquiries, which happen while you examine your personal credit score report and different conditions when your credit score is pulled for one thing apart from a lending choice, should not seen by lenders and should not thought-about in credit score scores.

7 Epic Credit score-Constructing Grasp Strikes

Now it’s time to deal with your credit-building targets. Listed below are seven methods that will help you take your credit score to the subsequent stage very quickly.

Turn into an Approved Person

A trusted buddy or member of the family could possibly add you to their credit score account as a certified consumer. As a bank card licensed consumer, your credit score report will mirror the credit score restrict and dependable fee historical past of the account.

Open a Joint Line of Credit score

Opening a joint line of credit score generally is a useful step in your credit-building journey. When you have somebody to handle your funds with, a joint line of credit score can present a chance so that you can construct credit score together with the joint account holder.

Nonetheless, there are some downsides to joint strains of credit score. They aren’t out there with all lenders, and for those who do select to open a joint account with somebody, you might not have the ability to take away the joint account holder if the connection sours.

Think about a Secured Credit score Card

A secured bank card requires an upfront money deposit to mitigate monetary threat to the lender in case you don’t pay your invoice. Most often, the deposit is the same as your credit score restrict. So, for those who deposit $1500, your spending restrict will seemingly be $1500.

Since secured bank cards sometimes have low credit score limits, you’ll want to preserve your balances low in order that your credit score report doesn’t present a excessive utilization charge.

If you’re simply getting began with credit score, a secured bank card generally is a good solution to get the ball rolling.

Set Up Automated Invoice Funds

Establishing automated invoice funds in your bank cards may also help you keep away from getting destructive marks in your credit score report.

In case you open any strains of credit score, it’s vital that you simply make on-time funds with the intention to construct up a optimistic credit score historical past. A great way to make sure that you at all times make on-time funds is to arrange automated invoice funds. With an automated fee system in place, you received’t have to fret about lacking a fee and hurting your credit score rating.

However even with automated funds, it’s a good suggestion to take a look at your payments every month to keep watch over your spending in addition to any probably fraudulent expenses.

Improve Your Credit score Restrict

If you have already got present bank cards, then contemplate asking your bank card supplier for an elevated credit score restrict. You’ll successfully decrease your credit score utilization charge with an elevated credit score restrict. With a decrease credit score utilization charge, you may see a rise in your credit score rating.

Pay Off Present Debt

On the flip aspect, you can even decrease your credit score utilization charge by paying off any present debt you at the moment have. Though paying off debt isn’t straightforward, it might present the credit score rating improve you’ve been searching for.

Need tips about paying off debt? See our article on the debt snowball technique vs. the debt avalanche technique.

Get Credit score For Your Payments

Do you know that you would be able to get credit score for a few of the payments you already pay? There are various credit score information companies on the market designed so as to add your utility, lease, and subscription funds to your credit score report.

For instance, Experian Increase, eCredable Carry, and RentReporters may also help you get credit score for the payments you already pay on time. In case you pay your payments on time, having that info in your credit score report might enhance your credit score rating.

Preventing Credit score Misinformation

In accordance with Doable, 4 in 7 Individuals are financially illiterate, so it ought to come as no shock that many Individuals are mystified by their credit score rating. Not solely that, however many consider in detrimental credit score myths, resulting in poor credit score decisions as a result of misinformation.

If you’re working with somebody to construct their credit score, you’ll have to work via some deeply embedded credit score rating myths. For instance, you may hear that checking your credit score rating lowers your credit score rating. However that’s fully inaccurate. Different frequent myths embody the idea that carrying a stability will enhance your credit score rating or the concept that your credit score rating doesn’t matter to your private funds.

As you dive into the method of constructing credit score, make the most of dependable assets to be taught extra about good credit score practices and take motion that will help you attain the credit score rating of your desires.

The Backside Line: Credit score-Constructing Is Achievable

credit score rating can open a world of economic potentialities equivalent to low-interest loans on main purchases, invaluable bank card perks, decrease insurance coverage premiums, decrease safety deposits, and extra. Though the method of constructing good credit score will take time, it’s an achievable objective regardless of the place you’re ranging from.

Need to be taught extra about your credit score? Benefit from the free assets provided by Tradeline Provide Firm, LLC.

[ad_2]

Source link

![8 Best Online Savings Accounts [June 2023]](https://investmentclublive.com/wp-content/uploads/2019/09/shutterstock_1448949023.jpg)