[ad_1]

Closing a bank card is a fairly simple course of – however earlier than you do, it’s essential to know the way it might influence your credit score rating. The results of closing a bank card account in your credit score rating primarily rely upon some other accounts you may have open. Nonetheless, your credit score utilization ratio will possible be probably the most quick influence.

Once you cancel a bank card, that line of credit score can now not contribute to your credit score profile. Because of this, any current balances from different accounts will take up a bigger portion of your whole obtainable credit score, inflicting your credit score utilization to leap and probably decreasing your rating.

Should you’re not new to constructing credit score and have had a number of accounts open for some time, it’s doable that closing your bank card received’t influence your credit score considerably. However verify if that’s the case earlier than you do.

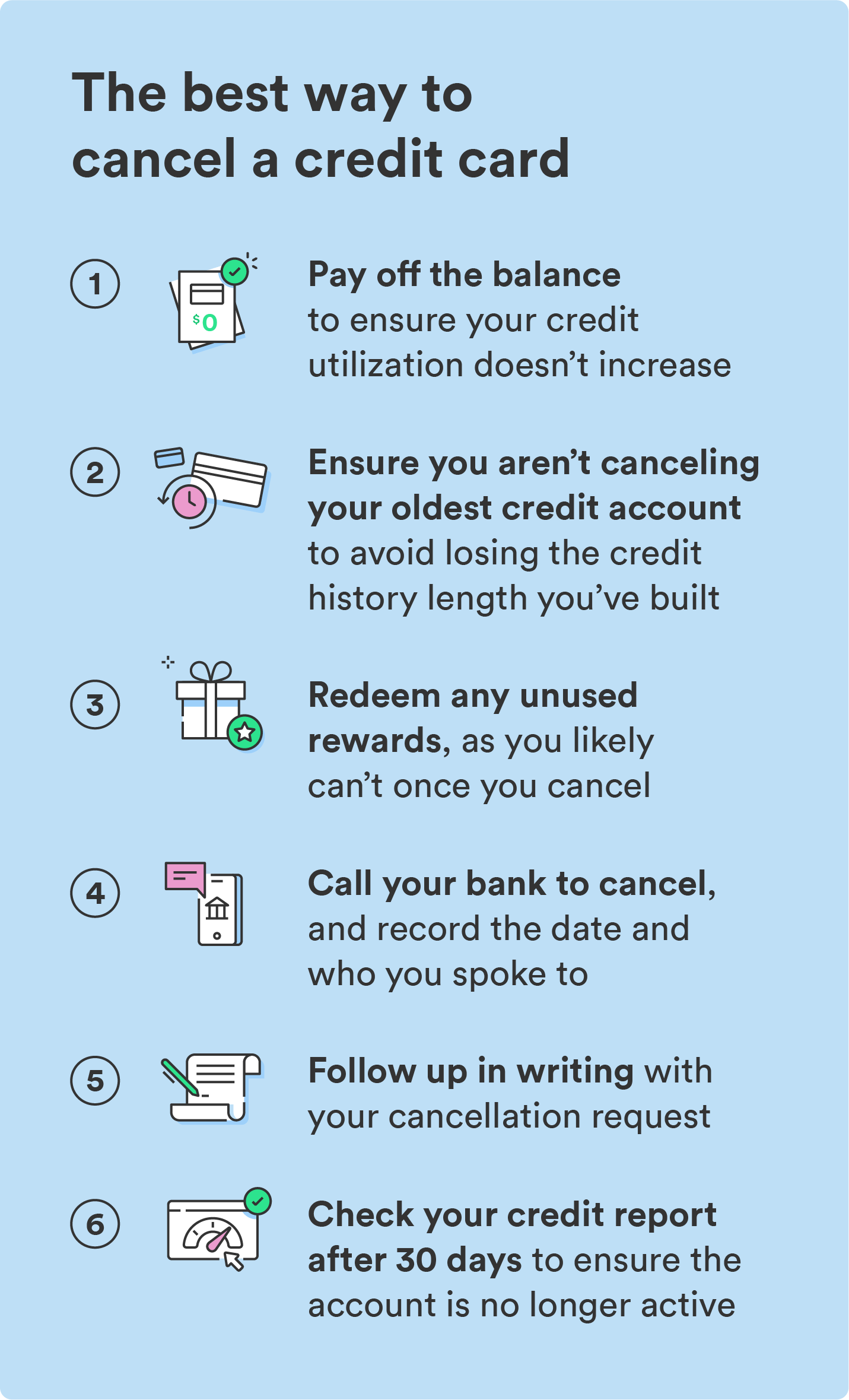

Under, we cowl the best method to cancel a bank card and shed some gentle on the query, “is it dangerous to shut a bank card?”

[ad_2]

Source link