[ad_1]

October 6, 2023 – There’s been plenty of chatter in regards to the Invoice Perkins ebook “Die With Zero” and its way of living and retirement planning. Most just lately, simply yesterday on the superior By accident Retired weblog. After a number of readers requested me about my views on the “Die With Zero” concept, I lastly relented and determined to write down a bit in my Secure Withdrawal Price Collection on the subject.

I’ll briefly describe the areas the place I agree with Perkins. However then I additionally undergo the entire fallacies on this method. Let’s have a look…

What I like in regards to the Die With Zero ebook

First, I see some parallels between Perkins and me. Like Perkins, I used to work in finance and referred to as it quits at a really productive level in my profession to give attention to extra necessary issues in life. In fact, Invoice Perkins’ web value is way increased, however in qualitative phrases, I can nonetheless relate to his life story. Why work into my 60s to construct a fair bigger nest egg once I had sufficient at age 44 to stay comfortably? Positive, I might need 10x-ed my web value over the 20 years of peak earnings between my mid-40s and mid-60s. I might have been much more comfy, however I might have paid the chance price of lacking out on lavish journey and the peace and tranquility of the relaxed suburban life right here in Camas, WA. So, in 2018, had the ebook been out then, I might not have discovered something pathbreaking and new. However I might have definitely loved Perkins’ work as a further motivational impetus to stop my job.

Second, I like Perkins’ concept of specializing in experiences over consumption of fabric items. Though, together with his nine-digit web value, I’m sure Perkins has some good materials stuff, too. However after all, the thought is that the majority materials stuff depreciates and fades, whereas recollections of previous experiences will flourish.

Third, I like the thought of not going too hard-core on the frugality concept when planning for FIRE. It jogs my memory of my common 2021 publish, Stealth Frugality, the place I suggest to stay a usually frugal life however don’t grow to be so frugal that folks begin speaking behind your again about what a weirdo you’ve grow to be. Because the title of the publish suggests, we had been frugal with out folks even noticing, sprinkling in some conspicuous consumption clues to the skin world. I didn’t must “borrow” a Netflix password from buddies and family or different loopy, unhinged antics that some of us within the FIRE neighborhood pursue. Positive, it took me a bit longer to achieve FIRE, however at the least I may benefit from the experience. Perkins would certainly agree.

Fourth, I like the thought of bringing extra folks into the FIRE neighborhood. The present FIRE influencers spend plenty of power advertising and marketing to folks with low web value ranges, say, the parents who simply graduated from Dave Ramsey, received out of debt, and at the moment are prepared and prepared to maintain going. That’s all a noble trigger, however few of us can have the stamina to undergo the probably 10-year or longer accumulation part to achieve FIRE. We must always develop the seek for FIRE fans to the already prosperous who, for some cause, don’t even notice they’re FIRE or near FIRE. I’m undecided there are lots of such “oblivious FI of us,” however we should always attempt to develop the motion any method we will.

However there are additionally a number of areas the place I’m afraid I’ve to disagree with Perkins’ work…

1: Die With Zero and Capital Depletion are nothing new!

Fairly intriguingly, the thought of depleting your portfolio shouldn’t be new. The success criterion of the 4% Rule is capital depletion. Depletion, as in “having $0.01 on the finish of retirement, counts as a hit.” I continuously hear folks speaking about how revolutionary the Die With Zero method is and the way it permits you to withdraw more cash and retire early. For instance:

[The Die With Zero method’s recommended nest egg] shall be decrease than the normal recommendation of multiplying your wage or spending by 25 – a well-liked calculation used and advisable by monetary planners that’s based mostly on an annual 4% withdrawal price. However, for many who need to spend down all their cash of their lifetime, that calculation might yield too excessive of an estimate.

Supply: Enterprise Insider, Could 15, 2021

I’ve to marvel: did I miss one thing? Did I misinterpret the Trinity Examine? No. It’s simply one other day of mathematically illiterate folks complicated and confounding easy mathematical and monetary ideas. Working example: the author(s) at Enterprise Insider falsely assumed that the Trinity Examine was based mostly on Captial Preservation. It’s not. Traditionally, utilizing a 75/25 portfolio and a 30-year horizon, the 4% rule would have run out of cash nearly 2% of the time. So, utilizing capital depletion (=dying with zero) because the success criterion, you’ll have succeeded 98% of the time.

Additionally, the 4% Rule would have preserved the (actual) preliminary portfolio worth solely 70% of the time. Actually, conditioning on a CAPE Ratio better than 20 (as we speak’s worth is nearer to 30), the chance of sustaining your (actual) portfolio worth after 30 years drops to lower than 50%. So, once more, the Trinity Examine, Invoice Bengen’s work, and far of the Secure Withdrawal evaluation on the market will not be normally based mostly on capital preservation. However please see Half 2 of the sequence for an in-depth evaluation of the capital depletion vs. preservation concern. I demonstrated that if you need capital preservation, you’d usually want a nest egg a lot bigger than 25x bills.

Thus, if folks declare that Die With Zero robotically permits you to withdraw extra and/or retire with a smaller nest egg (and due to this fact earlier) due to capital depletion, that’s false promoting. In Perkins’ protection, he isn’t explicitly making that Straw Man Argument in regards to the Trinity Examine. It’s principally the journalists and a few FIRE influencers. However Perkins can be not doing a lot to place this misunderstanding to relaxation both, so he’s at the least partially accountable.

However, I certainly concede that the 4% Rule probably results in a large nest egg on the finish of your retirement in 98-99% of the historic cohorts that didn’t run out of cash. So, I’m the primary to confess that in case you calibrate your withdrawal technique to the historic worst-case situations, you then set your self up for probably overaccumulating as a result of asset returns are risky, and it’s troublesome to select a withdrawal quantity that generates a “level touchdown” of $0 property and the tip of your life.

2: Huge overaccumulation in retirement isn’t that a lot of an issue.

In an interview, Perkins laments that almost all retirees don’t get near depleting their financial savings. He references a 2016 research that exhibits that the median 75+-year-old American has more cash than the median 65 to 74-year-old ($281,600 vs. $237,600). Within the ebook, he makes use of 224,100 and 264,800, respectively, that are the 2016 numbers in 2016 {dollars}, whereas the numbers within the Enterprise Insider article are the 2016 numbers in 2019 {dollars}. The ratios are the identical, although.

There are a number of issues together with his interpretation of those statistics. First, neither $281k nor $237k may be very spectacular. I don’t think about that overaccumulation. Wholesome 75-year-olds nonetheless have 10+ years of life expectancy, and way more when factoring in joint life expectations of {couples}. So, it’s not like $281k is all ineffective further money. If I assume $100k of that $281k is extra financial savings, how a lot is that actually within the grand scheme? When you assume a (conservative) 5% return on equities (over the long term, it was nearer to six.7%), this retiree may have spent a further annual quantity of $454.93 between the ages of 25 and 74 to decrease the retirement nest egg by these $100,000. Excel formulation: =PMT(0.05,50,0,-100000,1)

It’s higher than nothing, but it surely wouldn’t have made an enormous distinction in your young-age spending. You may’t miraculously ship these $100,000 by a time machine to your youthful self to fly in a non-public aircraft and celebration within the Bahamas (one of many creator’s memorable anecdotes). The problem right here once more is the time worth of cash. Somebody with finance coaching ought to know that!

Second, these numbers don’t essentially show that particular person retirees grew their web value. A single-year snapshot for 2016 doesn’t inform us something in regards to the web value of the present 75+ cohort once they had been youthful. For that, we’d want panel information, or the very least, the SCF information from years prior. If anybody has bother understanding the fundamental distinction between panel information vs. time sequence vs. cross-sectional information, please proceed your motivational speaker shtick, however keep out of debates about information evaluation! You’re embarrassing your self.

In addition to, in case you trouble to lookup the supply information on the Federal Reserve, you’ll find the next desk:

Effectively, isn’t that attention-grabbing? The 2019 Survey of Client Funds report consists of information for each 2016 and 2019. These 2019 figures had been out there on the ebook’s publication date. However Perkins mentions solely the (outdated!) 2016 quantity however ignores the more moderen 2019 figures as a result of they’d have negated his central premise. In 2019, the older cohort had a barely smaller median web value: $254.8k vs. $266.4k (=-4%) and a considerably decrease common web value: $977.6k vs. $1.217.7m (=-21%). Additionally, discover that between 2016 and 2019, each the median and imply web value of the 75+ cohort declined by 10% and 14%, respectively. Once more, resulting from composition modifications within the three years (new of us getting into the 75+ cohort and other people dying), it’s not solely acceptable to make too huge a deal of the % modifications. However this drop factors to a big withdrawal from retirement portfolios of the 75+ cohort, contemplating that the inventory market rallied by over 50% nominal and over 40% in actual phrases between 2016 and 2019.

Additionally, a extra prolonged pattern of family web value numbers from all of the previous Surveys of Client Funds carried out each three years between 1989 and 2019, more often than not, the 75+ cohort had a smaller web value than the youthful 65-74 cohort. The decrease web value is much more pronounced within the imply figures than the median numbers. So, specializing in that one little outlier blip from 2016 and ignoring all of the age cohort information, it seems like somebody is fudging the numbers. Sorry, Invoice, you simply misplaced plenty of popularity! You may have crossed the road of knowledge evaluation malpractice.

However you realize what? The previous few paragraphs are nonetheless principally moot. They primarily showcase his and his ghostwriters’ affirmation bias information hackery. Even when I had been to concede all factors to Perkins, particularly, that the typical retiree within the late 2010s and early 2020s has not spent a lot of his/her nest egg, that doesn’t imply something. Our present retiree inhabitants is probably going one of many luckiest ever. Most of them gathered property throughout the very best bull market ever, 1982-2001, with solely quick and shallow bear markets in between (1987, 1991). The Dot Com crash (2001-2003) and the World Monetary disaster (2007-2009) did produce deep fairness bear markets, however they had been quick and simply diversifiable with a big sufficient bond share. And the robust bull market since March 2009 – once more with short-term and shallow interruptions – can be among the best market rallies ever. In the present day’s retirees, aged 65+ and particularly 75+, skilled the very best Sequence of Return Danger conceivable. Good for them, however there isn’t any assure that future retiree generations will fare so effectively once more. Aspect be aware: there could also be a really slim slice of the present retiree inhabitants that retired at or across the bull market peak in 2000, however their numbers are too small to have a big impression on as we speak’s imply/median stats.

In distinction, retirees from the infamous 1929 and 1965-1968 cohorts could be about 120 to 160 years outdated as we speak. They’re now not round! However their reminiscence is. That details about previous drawdowns and previous inventory/bond correlations made it into the statistical distributions that rational and cheap monetary planners ought to make use of when drafting retirement plans, whether or not it’s skilled monetary planners or DIY amateurs like us within the FIRE neighborhood. And since no person may have recognized ex-ante how fantastically effectively monetary markets would work out ultimately, it’s no shock that we’ve some extra precautionary financial savings ex-post. However in a much less engaging market atmosphere, the online value of retirees would have appeared very completely different. As a former power dealer, Perkins needs to be aware of threat administration and the potential for an uneven threat profile. Having cash left over at age 95 is much less of a headache than working out of cash at age 75.

So, if you need my opinion on why there’s some extra web value within the stats, I can present two causes: First, the precautionary financial savings motive described above, i.e., folks hedging in opposition to a probably unfavorable market atmosphere. Ex-ante, that was the rational factor to do, though ex-post, folks can have some extra financial savings. The median traveler on the airport gate arrived too early for the departure. However it was nonetheless the rational factor to do as a result of losing half-hour on the airport is cheaper than arriving 1 minute late, lacking the flight, and having to purchase a brand new ticket.

The second cause is the shortage of useful steerage from the monetary planning neighborhood. All people reverts to some naive heuristic, just like the 4% Rule. To get a extra personalized answer, you’re probably caught with yours actually and possibly a handful of different small area of interest suppliers. For instance, in case you had retired in 2003 or 2009 and used a 4% Rule, it’s no marvel that your portfolio grew throughout your retirement. At and round these bear market bottoms, you must have used at the least a 5-6% withdrawal price to account for the engaging fairness valuations. So, I agree with Perkins that the mainstream retirement neighborhood is confused in regards to the quantitative facet of retirement planning. However Invoice Perkins’ is much more confused and proposes a fair dumber rule than the 4% Rule. This brings me to the subsequent concern…

3: The Die With Zero financial savings goal shouldn’t be linear within the horizon

That is in all probability probably the most disappointing function of Perkins’ work. You’ll assume that as a former finance skilled and power dealer, he’d spend way more time on his magic formulation, i.e., the financial savings goal you must aspire to retire. However the very best he can provide you with is that this:

Nest Egg Goal = Retirement horizon * annual finances * 0.7

That’s it? Why is the formulation linear within the retirement horizon? That goes in opposition to probably the most elementary monetary perception: the time worth of cash. You probably have twice the horizon, you shouldn’t want twice the nest egg as a result of the second half of your retirement wants lower than the primary half. (There’s, after all, one exception, particularly, when the anticipated actual return is zero, during which case the nest egg goal turns into linear, i.e., retirement horizon occasions annual finances. However you then would underestimate the goal by 30% as a result of you wouldn’t get that 0.7 multiplier.)

I can simply show how incorrect Invoice’s math is. First, assume you may entry an funding with a set actual price of return. One may use a TIPS ladder, for instance. Within the chart beneath, I plot the nest egg goal as a perform of the horizon. All traces are plotted as multiples of the annual finances. I achieve this for the DWZ formulation (T*0.7) and portfolios with completely different actual charges of return starting from 0% to six% p.a. I additionally plot the 4% Rule of Thumb as a single dot, i.e., 25x at a 30-year horizon. The traces are clearly not linear, aside from the aforementioned 0% price, the place you’d be method above the DWZ rule. Utilizing actual returns between 2% and three% (30y TIPS price as of 10/5/2023 is 2.50%), you’d want a a lot smaller nest egg for a really lengthy retirement horizon past 30 to 40 years. And also you’d want a considerably bigger nest egg than 0.7*T for brief horizons. Actually, not even with equity-like actual returns would you get away with a nest egg of solely 7x when your horizon is ten years. So, the Invoice Perkins formulation is totally incorrect and ineffective if you wish to implement it by a TIPS ladder. The curves will not be straight, and their slope shouldn’t be 0.7. (facet be aware: I’m conscious that TIPS solely exit to 30 years, so you should still face some residual rate of interest threat when going through a horizon of greater than 30 years).

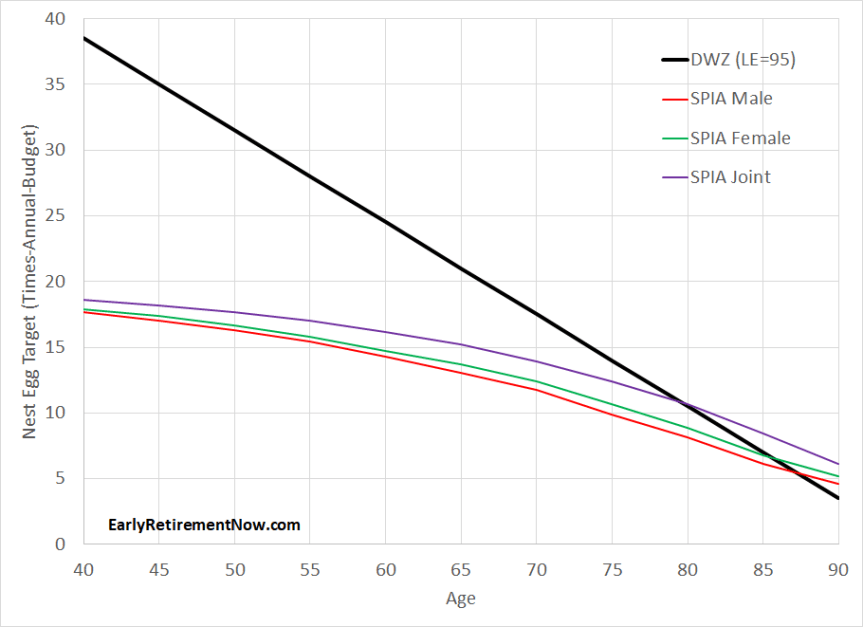

One other method could be a Single Premium Quick Annuity (SPIA). I went to the web site Quick Annuities (I’m not affiliated with them, however I like how simple it’s to get quotes there) and pulled some SPIA annuity quotes for males, females, and {couples} at completely different present ages between 40 and 90 years outdated (in 5-year steps). I assume the couple consists of a male and a feminine, each of the identical age. For the DWZ formulation, I assume a life expectancy of 95; for instance, a 40-year-old would use a 55-year horizon. Or a 65-year-old would goal the usual 30-year retirement horizon. Listed here are the online value targets as a number of of the annual finances and as a perform of the present age. Discover that the curves lower as a result of we’ve the retiree’s age, not the horizon, on the x-axis.

Discover how the curves will not be linear and have a slope nowhere close to 0.7. Actually, for youthful retirees, you once more want a a lot smaller nest egg than the 0.7*horizon formulation would recommend. But in addition discover that SPIAs will not be inflation-adjusted. Particularly over longer horizons, you count on to wipe out a big a part of your buying energy. For instance, 40-year-old retirees with a (potential) 55-year horizon would deplete about two-thirds of their buying energy, assuming a 2% pattern inflation price. At 2.5% inflation, you’ll erase 75% of your buying energy and greater than 81% when the CPI is 3%. Which may lower it too tight for early retirees with a frugal finances. Say, in case you assume you may survive on $25k as we speak, will you be capable to stay with dignity on $6-$8k a 12 months (inflation-adjusted) once you’re in your 90s? I don’t assume so!

So, in case you’re a 40-year-old retiree, you might be impressed with the whopping 5.66% SWR for single males, 5.58% for single females, and 5.38% for {couples}. However don’t be tempted to place your whole nest egg into one single nominal SPIA and retire with solely 17-19x your present finances. Go away a large(!) reserve to take care of the inevitable depletion of your buying energy! How do you do this? I mannequin this COLA adjustment as a withdrawal case research that slowly phases in withdrawals to make up for an assumed 2% inflation price. I’m utilizing a 75/25 portfolio and calculating the historic fail-safe cohort to see how a lot it is advisable put aside to precisely deplete your cash in that worst-case state of affairs. See the chart beneath. Now, we’ve shifted the minimal nest egg requirement to simply above 25x. It’s nonetheless higher than the 0.7*55=38.5 from the DWZ formulation. Don’t get too assured, although, as a result of inflation may are available a lot worse than 2%, which explains why SPIA+2% provides you a seemingly increased SWR/decrease nest egg goal than a conventional SWR evaluation.

But in addition discover that, as earlier than, the SPIA-recommended nest egg sizes are a lot bigger than the DWZ formulation once you get to your 80s. Right here, the nonlinearity of the withdrawal and annuity math works in opposition to you, and also you want considerably greater than the DWZ linear formulation would advocate.

Lastly, we will plot the failsafe retirement nest egg that will have survived a retirement utilizing a 75/25 portfolio with a capital depletion goal. That’s the usual ERN method, straight out of my Google Simulation Sheet (see Half 28 for particulars). Once more, nest egg targets will not be linear, and the slope isn’t 0.7.

You’d want greater than 25x to hedge a 30-year retirement as advisable by the 4% Rule (i.e., you want the additional money to hedge out that residual 1-2% threat of working out of cash). I additionally plot the nest egg goal once you mannequin a slowly declining actual retirement finances, melting away 1% of the finances yearly, and you may shift down the curve. Numerous of us, Perkins included, tout this consumption shrinkage because the panacea to retirement financial savings. There’s certainly a big drop within the nest egg goal, however the curve continues to be under no circumstances linear and doesn’t have a slope of 0.7 both.

Abstract to this point: your goal nest egg shouldn’t be linear in your retirement horizon. Not one of the generally used retirement techniques (TIPS ladder, SPIA, SWR evaluation a la Trinity or ERN) will ever generate a linear perform in your horizon. When you’re younger, you’ll want much less; in case you’re outdated, you’ll want greater than what Perkins recommends.

4: The financial savings goal ought to rely upon future anticipated money flows

One other concern that Perkins appears to disregard is that retirees might have future money flows. Younger retirees ought to definitely account for future Social Safety and pension revenue, albeit making use of a small lower to hedge in opposition to potential coverage threat. I cannot elaborate on this concern as a result of it ought to nonetheless be recent in everyone’s reminiscence after studying final month’s publish within the SWR Collection: Social Safety Timing – SWR Collection Half 59. However even conventional retirees typically prefer to account for, say, a possible future downgrade of their main residence or different supplemental flows. With out steerage on easy methods to consider such future flows, the already problematic linear nest egg advice turns into much more suspect.

5: The financial savings goal ought to rely upon asset valuations

Virtually as disappointing because the asinine linear nest egg formulation is the absence of any recognition of how asset valuations decide your nest egg goal. Working example: when Perkins wrote this ebook, ostensibly in 2020 and/or early 2021, we had rock-bottom rates of interest. 30-year TIPS charges had been beneath 0%, which might have implied that for a 30-year retirement, you’d want greater than 30x annual bills to hedge your retirement finances even with depletion over 30 years! Not 0.7*30=21x however 30+x!

In distinction, as we speak’s TIPS charges are once more at multi-decade highs. As I showcased in one of many charts above, with CPI-adjusted protected returns that top, you probably retire with a a lot smaller nest egg than the advice from the DWZ ebook. And once more, the good irony is that the event the place a linear nest egg goal may have been rational would have been the case of zero actual charges the place the nest egg goal would have been T*Finances. Not 0.7*T*Finances!

When you run a conventional protected withdrawal price evaluation, as I do right here on the weblog, fairness valuations are the massive gorilla within the room. As I’ve written on my weblog for seven years, your withdrawal technique needs to be extra cautious when the inventory market is at an all-time excessive vs. in a deep drawdown. Within the chart beneath, I plot the minimal nest egg per $1 of retirement finances to maintain your retirement even when we undergo a repeat of a historic wort-case occasion. Discover how the failsafe nest egg suggestions differ crucially relying on the fairness drawdown, between 0% (=fairness all-time-high) and 50% drawdown. If the market is underwater by that a lot initially of your retirement, you may maintain your retirement finances with a a lot smaller nest egg. I used to be shocked that Perkins, who labored in finance, didn’t assume fairness valuations needs to be extra distinguished in your retirement planning.

6: Hedging in opposition to old-age well being expenditure shocks is possible

The creator has a response to of us questioning in regards to the threat of well being and long-term care bills later in life. I’m paraphrasing right here: “Don’t even trouble; it’s so costly that you just poor little peasants and peons can’t afford it anyway.” He mentions how astronomically costly it was to pay for his father’s end-of-life care and the way even a number of days of care would have worn out most middle-class retirees’ nest eggs. What a tragic and defeatist angle. And the way condescending!

His line of reasoning jogs my memory of the Suze Orman spat from 5 years in the past when she argued that nursing houses price $300k a 12 months. In fact, Suze argued you want a bazillion {dollars} to retire to pay for a nursing residence, whereas Perkins makes use of the identical argument to push you within the different path, i.e., retire anyway and simply neglect a couple of nursing residence altogether. In fact, the fact for many strange of us who will not be within the 9-figure web value membership is completely different. There are cheaper choices for nursing houses. And most old-age of us ought to be capable to get away with a a lot decrease diploma of care, e.g., rent some home assist with cleansing, gardening, and so forth. There shall be a further price, and since no person is aware of how a lot precisely you have to to spend, it’s certainly rational to maintain some further precautionary financial savings round as a reserve. You may’t afford Suze’s Beverly Hills nursing residence, however these further financial savings will definitely offer you peace of thoughts to have the ability to pay for surprising prices later in retirement and stay a sleek life.

Furthermore, as I’ve written in a previous publish (“When to Fear, When to Wing It? – Half 47), as a result of the nursing residence keep or different old-age bills are to this point sooner or later, it’s normally not one thing on my thoughts proper now. Even a comparatively small bucket invested in 100% fairness index funds (because of the lengthy horizon) ought to offer you restful sleep at night time.

Abstract So Far

The Die With Zero method jogs my memory of a quote I as soon as heard from a professor of mine describing the work of one other economist I want to depart unnamed (fortunately, it wasn’t me!):

“Your work is each revolutionary and clever. Sadly, the revolutionary elements aren’t clever, and the clever elements aren’t revolutionary.”

In different phrases, Perkins’ tackle early retirement is definitely neat. His type is recent, and he exudes the excessive power and confidence – some would name it cockiness – of somebody with a excessive web value. I wouldn’t be shocked if he used considered one of Tony Robbins’ ghostwriters. Due to this fact, credit score the place credit score is due, the Die With Zero ebook and his complete philosophy are undoubtedly useful in bringing extra folks into the FIRE neighborhood, for instance, those that are turned off by FIRE’s (undeserved!) popularity of maximum and extreme frugality. A lot of folks shall be drawn into his narrative and impressed by somebody so fabulously wealthy and assured. However his concepts aren’t new and positively not revolutionary. His philosophy is a rehash of the “Your Cash or Your Life” ebook from a long time in the past (which he credit and references), simply upping the coolness issue a bit.

Nevertheless, when Perkins wanders off the overwhelmed path and showcases some “revolutionary” concepts, he rapidly turns into unintelligible and unintelligent. He has a legitimate level criticizing the established order of as we speak’s retirement planning panorama that leaves many retirees so uncomfortable touching the principal of their nest eggs. However what he proposes in its place, the asinine linear formulation (0.7 occasions horizon occasions finances), is even much less useful than the generic mainstream B.S. retirement planning instruments – in case you thought that was even attainable.

Perkins’ formulation, which ignores a few of the most elementary finance rules, i.e., time worth of cash and (highschool degree!) amortization math, would vastly exaggerate the goal nest egg for all FIRE retirees. With a 60-year horizon, he would suggest a 42x annual bills nest egg. However a easy 75/25 portfolio would have sustained a 3.25% withdrawal price, equal to solely 31x. And that’s for a bare-bones 60-year retirement with none future supplemental flows like Social Safety. With some supplemental flows, you may be capable to push your SWR again beneath 30 and probably even near 25x acquire. Particularly, Perkins’ formulation would all however assure that you just overaccumulate property throughout a FIRE-style retirement, the precise concern that Perkins laments a lot. What irony!

Likewise, for very quick horizons, say, below 15 years, the DWZ financial savings goal is much more harmful monetary malpractice. It’s far too low and can all however assure that cash doesn’t final so long as your horizon, even with very aggressive estimates of (CPI-adjusted) anticipated returns. Thus, no credible retirement planner would ever take the specific numerical suggestions in that ebook very significantly.

Fortunately, folks of their 70s and 80s would probably not even make it to the notorious formulation. After that barrage of condescension and insults in opposition to outdated of us of the sort “spend your cash whereas younger since you’ll be a ineffective and brainless vegetable once you’re older,” – most 70+-year-olds would have put down the ebook earlier than web page 160. Thus, Grandma and Grandpa will probably be protected from dangerous monetary recommendation for now! Whew!

A greater option to mannequin Die With Zero: The “Security First” Methodology

We may think about at the least partially shifting away from the stereotypical Trinity Examine method of hedging your longevity threat by yourself with a big inventory/bond portfolio. Security First typically entails shifting at the least a portion of the portfolio into different asset courses (TIPS ladders, QLACs, commonplace annuities, and so forth.), thus sacrificing some and even the entire portfolio progress upside for a better withdrawal price.

There are numerous flavors of the Security First method, and Wade Pfau wrote a superb abstract on Forbes. Since I’m already previous 5,000 phrases, I have to defer detailed simulations to a future publish. However it’s on my to-do checklist, so keep tuned and watch this area. I’ll current in a future publish how annuities and TIPS ladders can probably enhance protected withdrawal charges. Particularly, you quit a big portion of the upside, which some are completely satisfied to do as a result of they need to Die With Zero, however you additionally hedge in opposition to a few of the worst-case situations, just like the dangerous Sequence Danger occasions, a la 1929 or 1968, which will increase your failsafe withdrawal price.

As good as this all sounds, there may be one caveat. The attractiveness of the Security First method relies upon crucially on the rate of interest panorama. Because of the latest rise in charges – each nominal and actual (TIPS) charges – a few of the beforehand unattractive methods all of the sudden look fairly interesting. It could not final, so I hope I get that detailed publish prepared earlier than rates of interest drop once more!

Thanks for stopping by as we speak! Please depart your feedback and solutions beneath! Additionally, try the opposite elements of the sequence; see right here for a information to all elements to this point!

All the standard disclaimers apply!

Image Credit score: pixabay.com

Associated

[ad_2]

Source link