[ad_1]

As real-time funds have gained ubiquity licensed push cost fraud due to scams on each customers and companies have elevated exponentially. Fraudsters are very conscious of the variations between the ways and messaging required to commit a rip-off in comparison with different kinds of fraud. They even differ their method tailoring their methods to the precise rip-off sort.

The query arises: if fraudsters have labeled how they aim victims for various scams and use corresponding kinds of messaging, how successfully does your group categorize scams, regulate your buyer messaging, and establish and tag the totally different typologies in your information?

Not correctly distinguishing scams from different kinds of fraud and never successfully defining and categorizing scams has a number of knock-on implications for the fraud division, the enterprise as an entire and for purchasers:

Incomplete understanding of the dimensions of the scams downside inside your monetary institutionFirehose method to scams training for customersPoor communication with clients as a result of incapacity to appropriately establish potential scamsInability to successfully again check and perform what-if situations on rulesLess efficient fashions and diminished fraud detection from consortium rip-off fashions

Defining and Documenting Scams Typologies

The start line is guaranteeing that your fraud division has made and documented the excellence between transactional fraud typologies (account takeover, identification theft, Card Not Current (CNP), and many others.) and scams or licensed push cost fraud. From there scams must be categorized into totally different typologies (e.g. impersonation, funding, romance, and many others.). Every sort ought to be clearly documented and understood.

For these organizations that haven’t but established their typologies there are a number of assets that may assist. These embody:

New rip-off methods are launched on a reasonably common foundation. One want solely take into account the rise of cryptocurrency scams previously few years. Whereas this sort of rip-off has seen explosive progress, in actuality it’s basically simply one other type of an funding rip-off. When defining your listing of categorizations, try to be aware of over-classification of rip-off varieties. If additional classification is required for buyer communication, reporting or additional analytics, various information components (e.g. Service provider or Beneficiary Sorts) might be utilized.

Upon getting outlined and documented your scams typologies you will have to place them into follow by enabling analysts to tag any alerts primarily based in your rip-off typologies. Moreover, you’ll want to make sure that your investigative/claims course of and their corresponding information warehouses can accommodate scams data (distinction between fraud & rip-off, rip-off typology, and many others.).

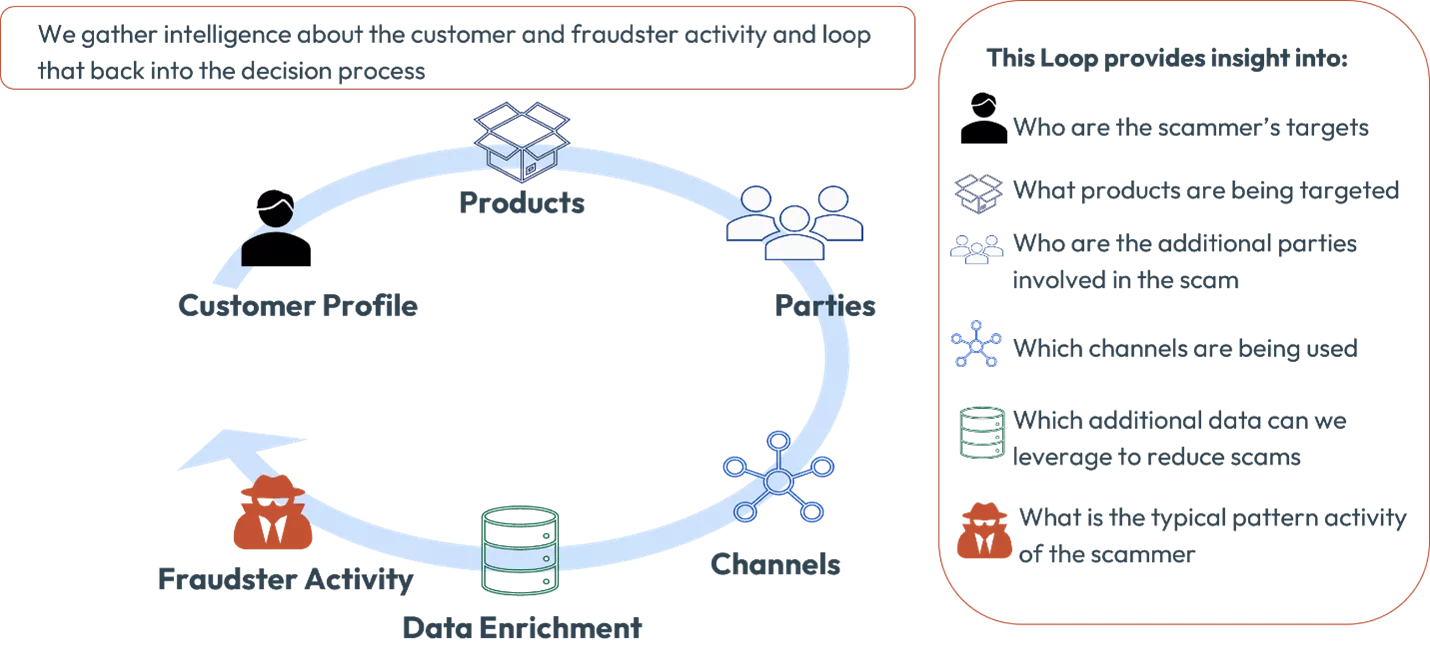

With these components enabled, it is possible for you to to place into place a Knowledge Intelligence Loop for scams.

This Knowledge Intelligence Loop facilitates steady enchancment of Fraud Controls and subsequently drives down fraud losses and minimizes buyer friction by providing you with the data you want to make higher selections. With out this in place you might be flying blind with regards to constructing out and refining methods to fight scams.

As soon as your fraud group has outlined, documented, and put into follow this Knowledge Intelligence Loop there are an a variety of benefits together with:

Higher Insights

With efficient information tagging for scams and supporting information storage capabilities in place, your group can make the most of this information to achieve higher insights about scams. In flip this results in the added advantages of:

Higher reporting – With out the flexibility to tag alert tendencies in line with your rip-off typologies, understanding the scope and nature of the scams downside will stay guesswork at greatest. Tagging information unlocks your means to create studies on rip-off exercise. This isn’t solely essential from an inside want, however as we’ve highlighted in plenty of latest weblog posts on my own about developments in Latin America and my colleague Szymon Morytko on APJ, we’ve seen plenty of jurisdictions not too long ago pushing monetary establishments to share information on scams.Compelling enterprise case – Higher reporting varieties the premise for constructing a greater enterprise case for tackling scams. Whether or not it’s using a scams mannequin, higher consumer communication instruments or procurement of third-party information to reinforce your selections, all of them require a enterprise justification for the funding. Should you can’t quantify the issue and the impression in your monetary establishment and your clients, then no quantity of debate will justify the additional price range.Clear understanding of precise consumer training wants – Taking a scattershot method to the training of purchasers on scams is a waste of assets and cash. If we’re higher in a position to perceive the kinds of scams purchasers are being focused by, then we are able to focus our assets on these wants, reasonably than a generalist method to Scams Schooling.

Higher Choices

Higher selections are pushed by higher insights. By gathering extra details about scams we are able to fine-tune and even develop new methods to sort out scams, together with:

Centered guidelines – The ways utilized in a rip-off by a fraudster are totally different than different transactional fraud topologies. We can not anticipate that the foundations for Card Not Current (CNP) fraud or Account Takeover to be as efficient in overlaying scams as focused guidelines particular to scams. With tagging in place and the flexibility to backtest particularly for scams, we are able to fine-tune or devise new guidelines to focus on scams and yield higher outcomes for rip-off prevention. Capability to leverage fashions – By tagging scams inside your information you possibly can construct your individual customized fashions or make the most of vendor-supplied fashions. Moreover, the tagging of scams means that you can contribute to and higher make the most of scams consortium fashions. This implies you’ll profit from the expertise of different monetary establishments in figuring out current scams and scams that will not have but reached your monetary establishment.Focused queues – The deployment of scams particular guidelines and fashions enhances the therapy of alerts as they now might be routed to rip-off particular queues, reasonably than extra generalized queues. The alert can then be dispositioned by an analyst who’s educated within the investigation and therapy of potential scams and their victims.

Higher Communications with Shoppers

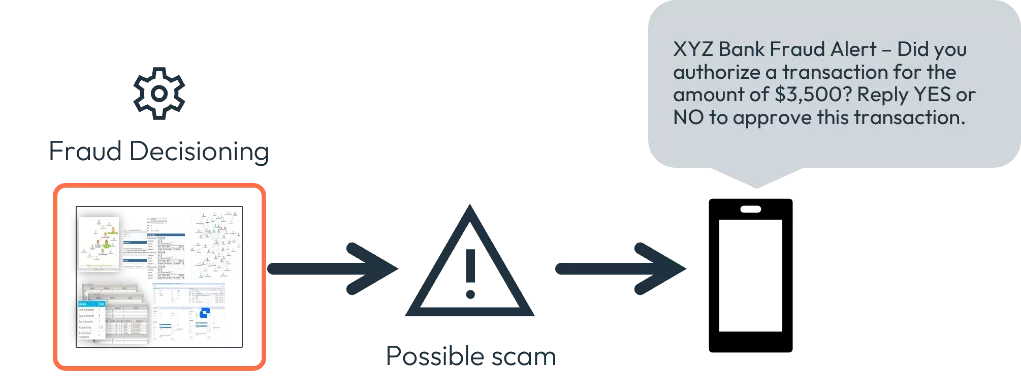

Efficient buyer communication is all about getting the proper message to the client on the proper time. Beneath we have now an instance of the normal messaging we see when a transaction is deemed to be suspicious. This kind of message might be efficient in stopping conventional fraudulent transactions, similar to CNP fraud or card skimming.

Nonetheless, we must always query how efficient this sort of message is when it’s not the fraudster finishing up the transaction, however reasonably the client. The shopper could imagine that the transaction they’re finishing up is respectable or could even have obtained teaching from the scammer on what to do once they obtain this sort of message.

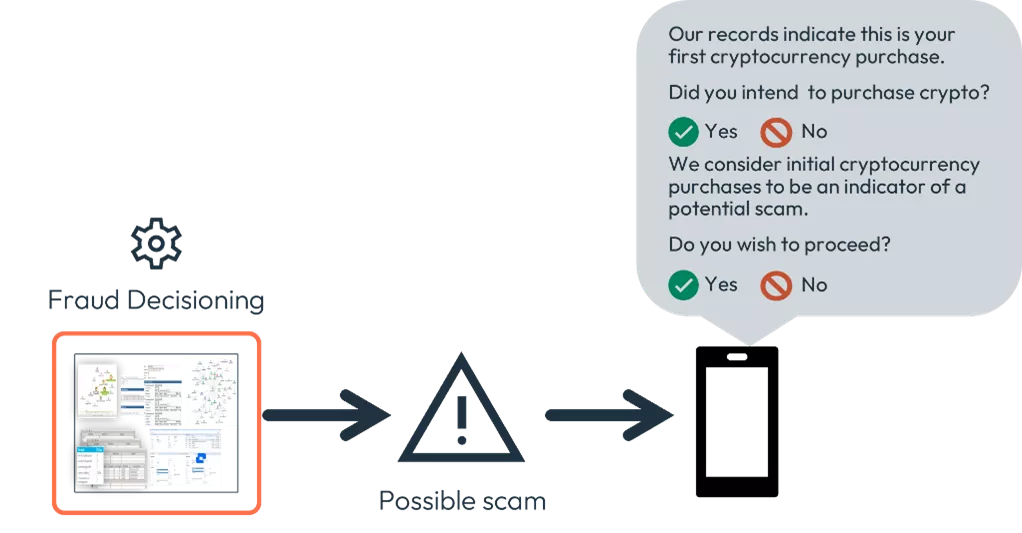

After we suspect a buyer is being scammed, we must always use focused messaging that breaks the fraudsters spell and drives customers to consider whether or not the transaction is the truth is respectable.

As we see within the instance message above, we try to get the client to grasp the potential dangers of the transaction and take a second to contemplate their actions. That is tailor-made, customer-specific, transaction particular sort of intervention, which is strictly what’s what the UK’s Cost Service Regulator (PSR) referred to as for of their Shopper Commonplace of Warning Exception Steering doc.

It isn’t simply the messaging on the time of a possible rip-off transaction that’s essential. Shopper communications round scams will turn into much more essential as extra formalized legal responsibility fashions come into place as a result of regulation just like the UK’s 50/50 legal responsibility proposal. As a part of the claims administration course of, receiving monetary establishments might want to reply to the sending monetary establishments’ data requests.

This probably requires extra data or attestation be requested from the consumer. This should be thought of with the expectation of speedy response instances enforced by regulation. It’s paramount that monetary establishments begin to take into account how they may have the ability to handle this sort of extra, speedy communications requirement as quickly as doable.

FICO’s fraud consulting group stands prepared to assist clients globally fight scams by means of using fraud decisioning guidelines, scams fashions and automatic, bespoke communications strategies.

How FICO Helps Detect and Stop Scams

[ad_2]

Source link